“Plan to Prosper”

Winner’s – Make plans and Do, Loser’s do quite

opposite,this is much applicable in Wealth Creation also.

The

high-rise buildings are the new norms in today’s urban world and spacious ones

in rural. One might admire looking at the tall buildings, the design and art it

carries but most fail to remember that a strong foundation is the basis of this

glory.

Visualising

a Dream home, Dream holiday destination, Dream car, Quality Child’s education

and Financial Freedom are quite common in most Indian minds. There are two choices

to make these dreams come true either with Your money or with the Banker’s

money if your choice is former then chances of achieving your financial goals

are high the later might put into financial mess and hard to come out of it. It’s

been always said that Indian families do a pretty good savings (Experts suggest

at least 20% of your income should go into savings and investments) but in FY-22

the savings stood at 7.3% a 30 year low because of an increasing in lifestyle

consumption and lower GDP, this is an alarming one if any of these becomes a

trend. Consistent savings and Investments are the best way to achieve your financial

dreams.

Have a proper

Financial Planning before you get into Financial Market because financial products

are not only complex, it is dynamic and time consuming also, whether it could

be just a Fixed deposit (FD) or Postal Savings or buying a Life Insurance contract

or getting into Capital Market or a Home/Personal loan. Consult an expert before

you proceed, the mantra is always “Plan to Prosper”.

Selling stocks

or redeeming Mutual Funds units for an emergency need or taking a bank loan to

purchase dream car, house or holiday plan shows that no proper financial

planning is in place or could be a self-made irrational financial planning. Get

in touch with your certified financial planner to make a proper plan and to

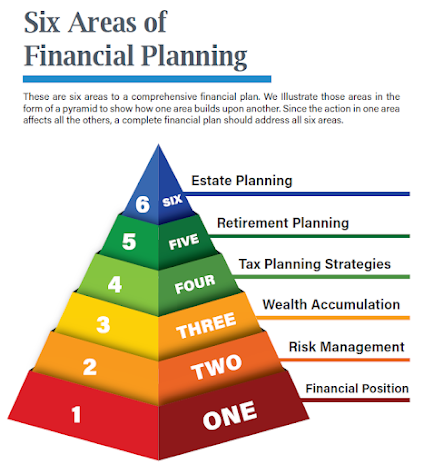

strategies a plan to achieve your financial goals. A prudent financial planner makes

a customized plan by understanding current financial position, risk exposed, loans,

surplus funds etc and helps to achieve financial goals.

Realistic observations and genuine tips. Explained lucidly without exaggeration. Overall, very useful Post!

ReplyDeleteThanks for the compliments.

ReplyDeleteVery informative and usefull. It will help the family to plan their wealth creation. Thanks for this article.

ReplyDeleteGood article, really helpful for planing the families financial planning

ReplyDeleteValuable advice on financial planning and investment decisions, emphasizing the importance of a strong foundation, risk management, and consulting with a certified financial planner for customized solutions.

ReplyDeleteGood article for financial planning of a family

ReplyDeleteSecuring a personal loan for marriage can be a wise choice, as it provides the necessary financial support to create your dream wedding. It's a convenient solution to cover expenses and make your special day memorable

ReplyDelete